Self-funded employers are increasingly focused on holistic health management strategies to drive improved health and cost outcomes across the medical and pharmacy benefits on an integrated basis.

For health plans, this means their ability to win and retain business requires more than just the best discounts and broadest network. Instead, they must differentiate themselves with next-generation digital health management strategies that improve “whole person” health—and keep their customers’ employees happy and productive on the job.

What does that mean for your commercial growth strategy? How can you deliver new, unique value that makes you stand out to large employers? What can you do to create new revenue streams around “value-add” initiatives and highlight your ability to be a critical asset in managing total cost of care?

Here are five ways Certilytics has worked with health plans to successfully deploy value-based analytics and help them achieve their commercial growth objectives:

1. Predict and Manage Modifiable Risk Rather than React to Past Utilization

The most innovative health plans aren’t just calculating risk—they’re predicting modifiable risk to unlock value (i.e., better quality and lower costs).

For instance, your highest-cost members aren’t always the ones who will benefit most from clinical interventions. A member with less predicted risk—but more open care gaps or redirection opportunities—might be a better candidate for outreach, especially if the member shows a high propensity for engagement. Successful health plans are defining and measuring distinct cost and quality metrics that matter and are actionable.

With the Forecasts Risk Stratification tool, users can quickly prioritize the members most likely to see reduced costs and improved health outcomes.

Health plans use our predictive insights not only to identify how likely each member is to utilize healthcare services in the future, but also each member’s likelihood of engaging with specific types of outreach. This opens the door to more effective, targeted outreach strategies and performance-based pricing arrangements, as well as proactive and preventative chronic disease management.

One national insurer found that members identified as highly likely to engage by our models were 2.6 times likelier to change their behaviors as a result of clinical outreach.

2. Align (rather than just aggregate) Your Data

With the substantial rise in specialty pharmacy spend, employers increasingly expect their health plan partners to offer a comprehensive view of utilization – especially when carving-in the pharmacy benefit. The most effective health plans are able to integrate data from the member, provider, and plan sponsor and demonstrate an ability to modify behaviors that impact total healthcare costs.

Health plans use the Certilytics Healthcare Data & Prediction Platform to collect, cleanse, and standardize their data across multiple sources and formats to provide a single, standardized repository that captures every facet of a member’s journey. This powerful, HITRUST CSF®-certified data processing tool is the first step for generating the insights required to implement effective member outreach strategies and incentivizing providers to switch from fee-for-service to value-based “whole person” health.

3. Get Creative with Your Pricing Model

Forward-looking employers want a true partner when it comes to managing the health of their employees. This works best when all stakeholders are incentivized to ensure members receive the most efficient and effective care possible.

With value-based analytics, health plans now have the tools to move beyond a traditional, fee-based ASO pricing model. They can take upside and downside risk based on the effectiveness of their health management and provider engagement strategies. These health plans are no longer seen by employers as a “utility” but instead as a true partner in fostering a personalized and integrated delivery system to employees.

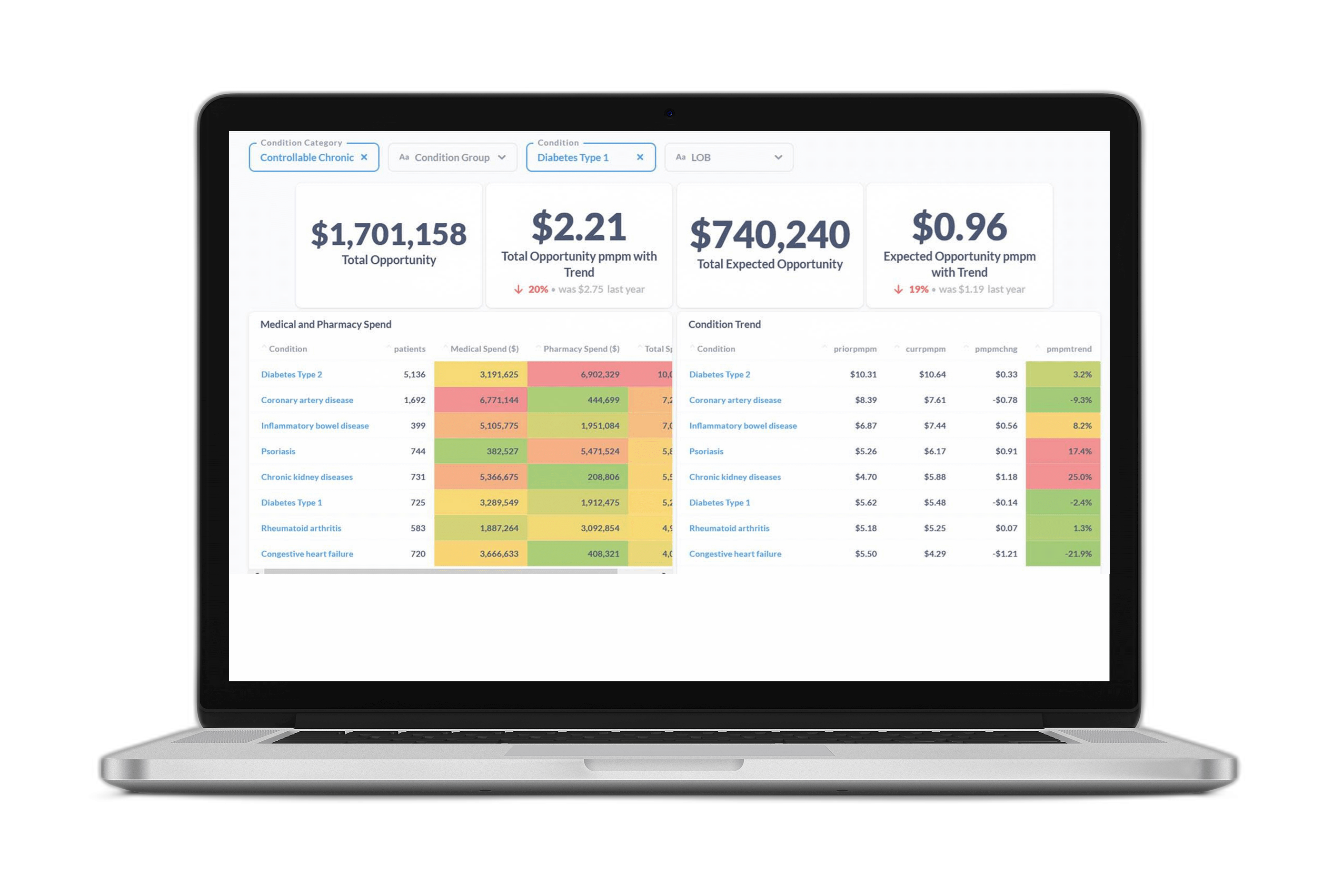

The Certilytics Opportunity Framework makes these innovative pricing arrangements possible by showing the dollar value of the financial opportunity that exists within our customers’ populations—and enabling them to evaluate their success in realizing that value.

4. Align Your Clinical and Financial Strategies

Clinical and financial stakeholders often work off inconsistent reporting generated from different datasets, analytics, and assumptions. This can lead to a lack of alignment within an organization and create challenges when talking to customers and reconciling clinical management strategies with financial pricing models and performance guarantees.

All of Certilytics’ analytics are generated off the same data and assumptions – unified by the Opportunity Framework – to provide users with consistent insights and ensure the member and provider engagement strategies of the clinical team are aligned with value-based pricing models and performance guarantees. In this way, health plans can match the characteristics of their covered populations with “packaged” clinical resources and enforce transparent, mutually acceptable protocols to measure, report, and reconcile financial and clinical achievements with customers and their consultants.

5. Use Flexible, Pressure-Tested Tools

One size no longer fits all. Legacy vendors with decades-old tools rely on labor-intensive manual processes, which are difficult to scale. The most innovative vendors have modern, flexible technology stacks capable of processing data representing tens—or even hundreds—of millions of patient lives on a cadence chosen by the customer.

The Certilytics Healthcare Data & Prediction Platform can seamlessly integrate with existing tools or serve as a standalone solution, integrating disconnected data and empowering health plans to quickly pivot to meet employers’ needs with accurate and aligned insights.

Learn More:

For a free consultation with our team of experts to energize your sales strategy, contact us: contact@certilytics.com