Last year’s government funding bill, the Consolidated Appropriations Act of 2021, made headlines for expanding telehealth and protecting against surprise billing. But another provision that received less attention but could have huge impact makes self-insured employers the fiduciaries for the healthcare services that they purchase.

What does this mean for employers? Essentially, self-insured employers will now have both more power and more responsibility as they design benefits plans for their employees.

As Elizabeth Mitchell, CEO of the Purchaser Business Group on Health, explained to Fierce Healthcare, the provision will require benefit partners such as health plans, PBMs, and consultants to become “transparent and accountable.”

“Most of the healthcare system is not ready for that, so there is going to be increased pressure from purchasers to make sure that they are paying for the right things that improve health and well-being,” Mitchell said.

Here are three ways for employers to be more proactive about benefit decisions and effectively leverage this new responsibility:

1. Unify Data for a Comprehensive View of Health

HR and benefits teams invest a lot in existing benefit programs, and must sift through a wide array of data from disparate sources as they try to understand which programs are most effective.

Studies have noted that a major challenge for these teams is integrating data beyond just medical and pharmacy claims in order to understand which solutions are meeting the unique needs of employees and their families.

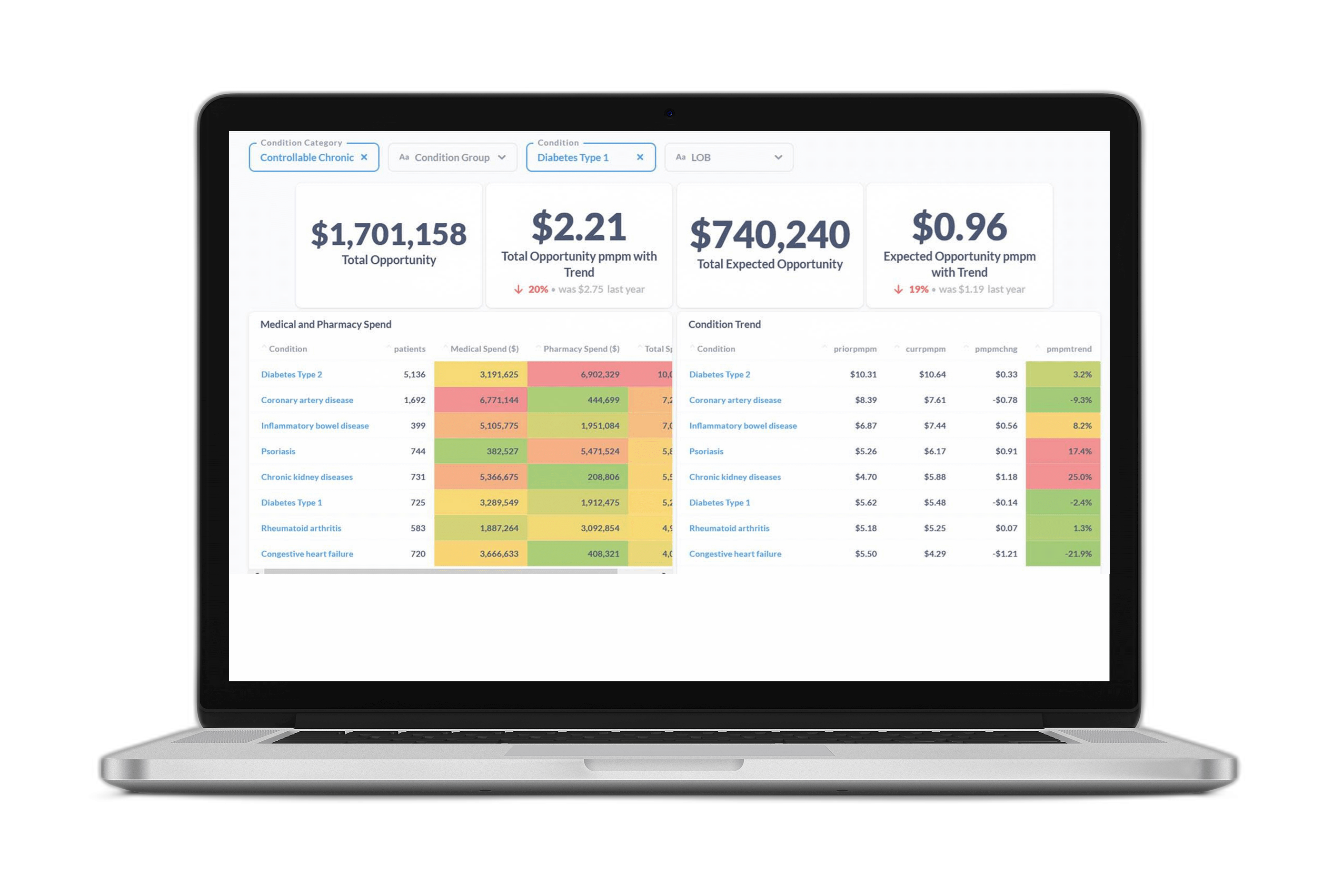

An effective predictive analytics platform unifies all the data from these existing vendors and health plan partners so that HR and benefit teams can uncover cost savings and understand not just the existing needs of their employees, but their emerging needs as well.

2. Design Impactful Strategies & Evaluate Programs

Predictive insights are necessary to understand the major drivers of risk within a workforce, along with which outreach methods would generate higher levels of engagement from employees. For example, two employees may share a need for diabetes prevention services, but one may be better served with greater access to telehealth services, while another would be more receptive to a wellness exercise app.

To design the most impactful strategies, employers use predictive analytics to match the right employee to the right program at the right time.

Employers need real-time, forward-looking insights that measure the performance of their existing point solution programs, and help them gain confidence in their future investments.

An advanced machine learning platform that integrates data beyond just medical and pharmacy claims enables employers to understand what may be driving changes in engagement, measure feedback, and pinpoint where additional resources would add the most value.

With this insight, employers can effectively evaluate programs and understand what additional investments may be needed.

2. Reduce Total Cost of Care

For purchasers who have long seen healthcare costs climb without a corresponding increase in quality, the Consolidated Appropriations Act is a welcome imperative to ensure benefit decisions don’t just improve employee health, but reduce costs as well.

Predictive insights from an effective advanced machine learning platform allow employers to track the progress of point solution programs in real time and understand which employees are not only at risk, but those who are most likely to respond to outreach.

Leveraging this intelligence means employers can get ahead of a high-cost event, and start discussions with health plan partners with an understanding of the drivers not just of cost, but avoidable cost.

Health plan partners are then incentivized to demonstrate the effectiveness of their programs and meet value-based goals.

Want to learn more?

Certilytics is the transformative data and predictive analytics partner for a rapidly growing number of the nation’s largest healthcare organizations and employers that are leading the shift to AI-powered, value-focused decision-making.

Check out our case study and see how we helped one Fortune 100 employer maximize benefits program impact to achieve $200 PMPY in savings.